Next: Minsky's unusual system dynamics

Up: If you are experienced

Previous: If you are experienced

Contents

Godley tables are a unique feature of Minsky. They are based

on what could be called the world's first GUI (``Graphical User Interface''),

the accountant's double-entry bookkeeping table.

Double-entry was invented in 15th century Italy

to enable accurate recording of financial transactions. The essence

of this method is (a) to classify all of an entity's accounts as either

Assets or Liabilities, with the difference between them representing

the Equity of the entity; and (b) to record every transaction twice,

once as a Credit  and once as a Debit

and once as a Debit  ,

where the definitions of Credit and Debit entries for Assets, Liabilities

and Equity are designed to ensure that the transaction was accurately

recorded. Minsky uses this GUI to generate stock-flow consistent models

of financial flows, but by default uses plus

,

where the definitions of Credit and Debit entries for Assets, Liabilities

and Equity are designed to ensure that the transaction was accurately

recorded. Minsky uses this GUI to generate stock-flow consistent models

of financial flows, but by default uses plus  and

minus

and

minus  operators (though the accountant's convention

of Credit

operators (though the accountant's convention

of Credit  and Debit

and Debit  can be chosen

via the Options menu). This system guarantees that, no matter how

complex the model is, the equations are internally consistent.

can be chosen

via the Options menu). This system guarantees that, no matter how

complex the model is, the equations are internally consistent.

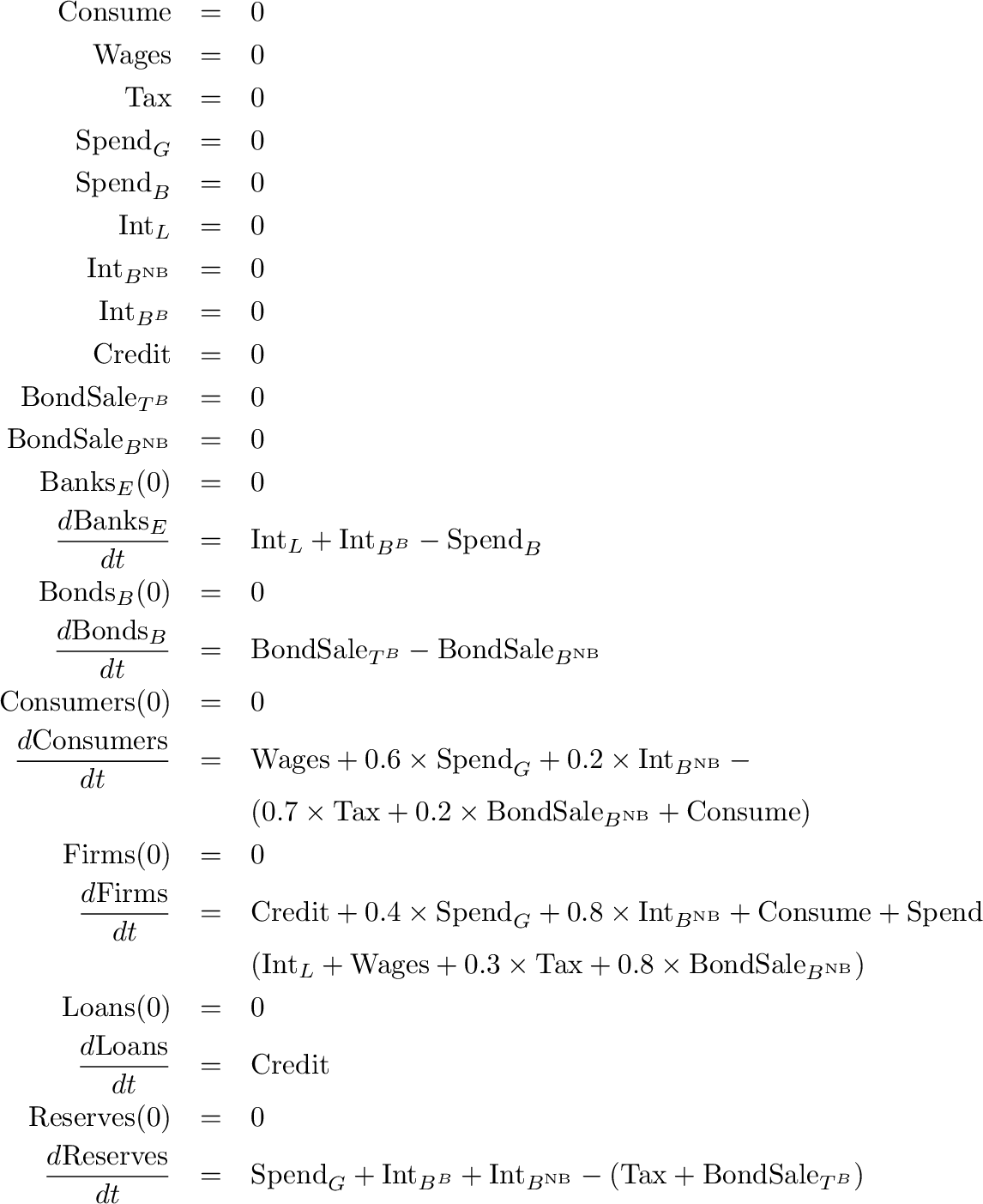

Minsky uses this GUI to generate systems of ordinary differential

equations to model financial flows. The columns specify stocks, while

the entries in rows are flows. The symbolic sum of a column

is thus the rate of change of the associated stock. Minsky

takes a table like the next figure:

![\includegraphics[width=\textwidth]{images/GodleyTableSingle}% WIDTH=527 HEIGHT=275](img313.png)

And converts it into a set of dynamic equations, which by construction

are ``stock-flow consistent'':

The model is completed by defining the flows on the canvas.

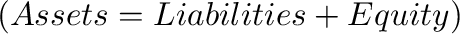

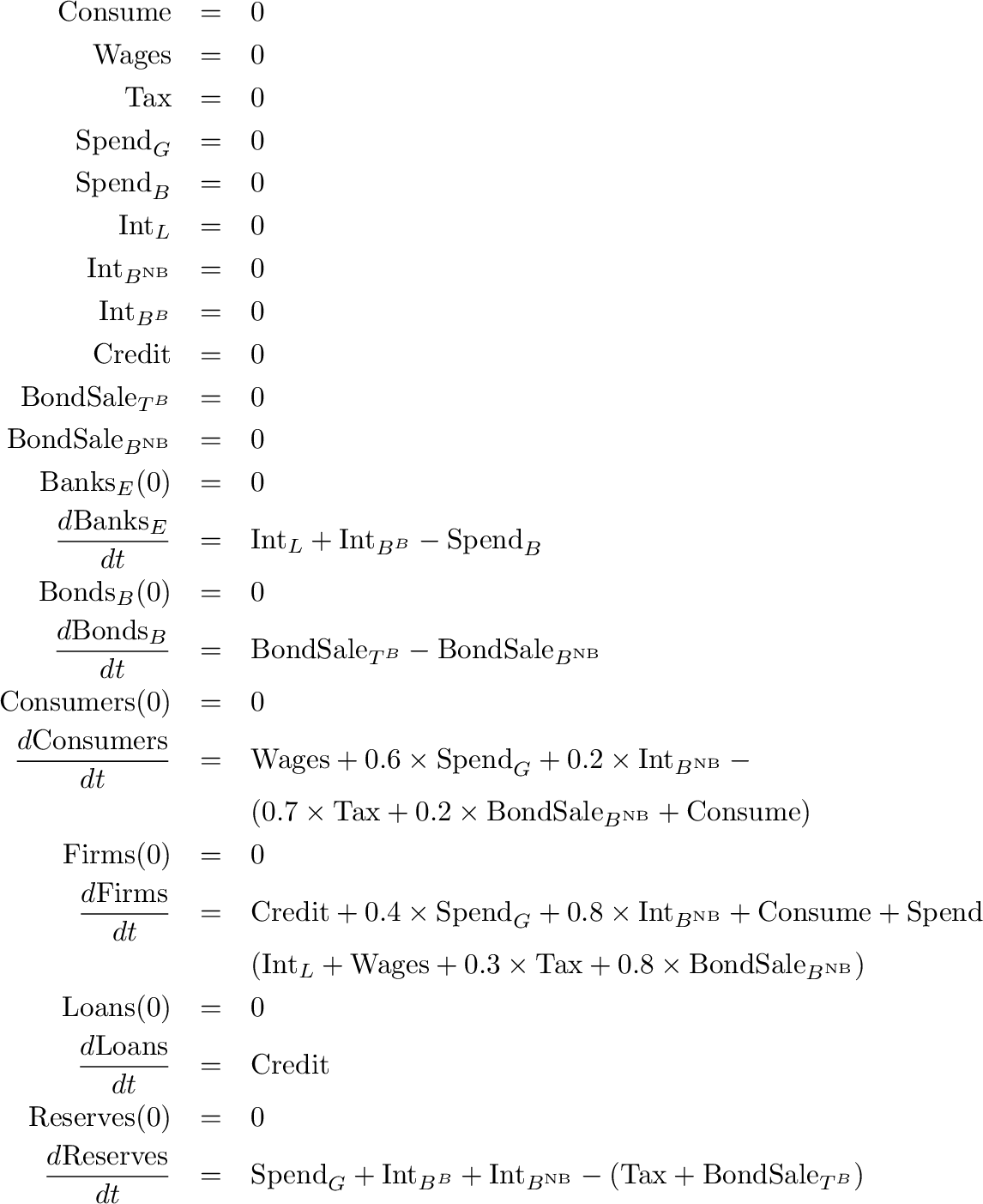

In addition, because one entity's financial asset is another's financial

liability, Minsky enables the construction of a multi-sectoral

view of financial transactions. The wedge next to every account name

is used on other tables to search for Assets that have not yet been

recorded as a Liability, and vice versa. For example, the previous

Table recorded the financial system from the point of view of the

Banking Sector, for which Reserves—the deposit accounts of private

banks at the Central Bank–are an Asset. Reserves are also a liability

of the Central Bank, and that can be shown in Minsky by adding

an additional Godley Table, naming it Central Bank, and recording

Reserves as a Liability:

![\includegraphics[width=\textwidth]{images/GodleyTableSecondIncomplete}% WIDTH=527 HEIGHT=246](img314.png)

At this stage, the financial transactions have been entered only once—against

the Central Bank's Liability of Reserves. Each transaction has to

be entered a second time to complete its record, but at present there

are no available accounts in which to record the transactions a second

time.

![\includegraphics[width=\textwidth]{images/GodleyTableSecondIncomplete}% WIDTH=527 HEIGHT=246](img314.png)

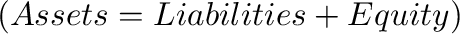

Bond purchases by the Central Bank indicate the need for to show bonds

owned by the Central Bank as an asset, while the other transactions

indicate the need to show the Treasury's account at the Central Bank,

the ``Consolidated Revenue Fund'', as an additional liability:

![\includegraphics[width=\textwidth]{images/GodleyTableSecondComplete}% WIDTH=527 HEIGHT=214](img315.png)

This is an inherently better way to generate a dynamic model of financial

flows than the flowchart method used by all other system dynamics

programs, for at least four reasons:

- All financial transactions are flows between entities. The tabular

layout captures this in a very natural way: each row shows where a

flow originates, and where it ends up;

- The program imposes the rules of double-entry bookkeeping, in which

entries on each row balance to zero according to the accounting

equation

. If you don't ensure that

each flow starts somewhere and ends somewhere, then the program will

identify your mistake;

. If you don't ensure that

each flow starts somewhere and ends somewhere, then the program will

identify your mistake;

- The double-entry perspective assists in the completion of a model,

since the requirement of a matching entry for each transaction indicates

the accounts that are needed to complete the accounting; and

- Double-entry bookkeeping acts as a prohibition against recording invalid

transactions.

Minsky thus adds an element to the system dynamics toolkit

which is essential for modeling the monetary flows that are an intrinsic

aspect of a market economy.

Next: Minsky's unusual system dynamics

Up: If you are experienced

Previous: If you are experienced

Contents

and once as a Debit

and once as a Debit  ,

where the definitions of Credit and Debit entries for Assets, Liabilities

and Equity are designed to ensure that the transaction was accurately

recorded. Minsky uses this GUI to generate stock-flow consistent models

of financial flows, but by default uses plus

,

where the definitions of Credit and Debit entries for Assets, Liabilities

and Equity are designed to ensure that the transaction was accurately

recorded. Minsky uses this GUI to generate stock-flow consistent models

of financial flows, but by default uses plus  and

minus

and

minus  operators (though the accountant's convention

of Credit

operators (though the accountant's convention

of Credit  and Debit

and Debit  can be chosen

via the Options menu). This system guarantees that, no matter how

complex the model is, the equations are internally consistent.

can be chosen

via the Options menu). This system guarantees that, no matter how

complex the model is, the equations are internally consistent.

![\includegraphics[width=\textwidth]{images/GodleyTableSingle}% WIDTH=527 HEIGHT=275](img313.png)

![\includegraphics[width=\textwidth]{images/GodleyTableSecondIncomplete}% WIDTH=527 HEIGHT=246](img314.png)

![\includegraphics[width=\textwidth]{images/GodleyTableSecondComplete}% WIDTH=527 HEIGHT=214](img315.png)

. If you don't ensure that

each flow starts somewhere and ends somewhere, then the program will

identify your mistake;

. If you don't ensure that

each flow starts somewhere and ends somewhere, then the program will

identify your mistake;